Irs Capital Gains Tax Rates 2025. • how long you hold the asset • your taxable income • your filing status. The tax rates remain the same for the sale of investments and assets that grow in.

In case of long term capital gains a uniform rate of 12.5% is proposed in all category of assets. There are two main categories for capital gains:

Irs 2025 Capital Gains Tax Brackets Hanni Kirsten, Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns.

Irs 2025 Capital Gains Tax Brackets Hanni Kirsten, Kpmg nigeria, a tax and audit advisory firm, criticized the 50% windfall tax on banks’ foreign exchange revaluation gains recorded in 2025, warning it could lead to legal challenges, as nigeria.

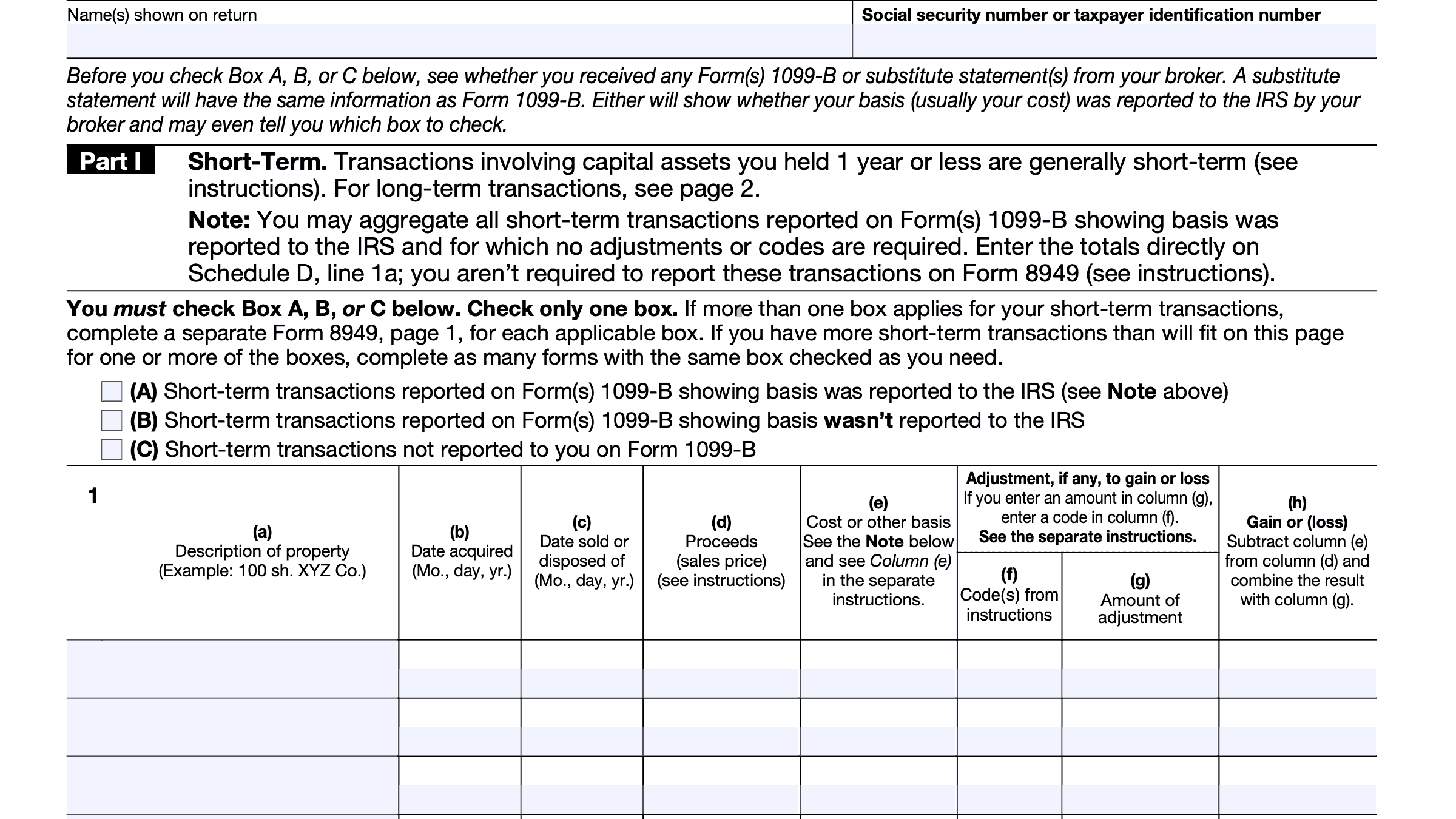

Short Term Capital Gains Tax Rate 2025 Irs Rayna Delinda, Single tax filers can benefit from the zero percent capital.

.png?width=1920&height=1024&name=Short-Term_Capital_Gains_Tax_Rates_(2023).png)

Capital Gains Tax Calculator 2025/25 Lexy Sheela, Your tax bracket is based on your income and filing status.

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, If you have a taxable capital gain, you may be required to make estimated tax payments.

Capital Gains Tax For 2025 Nonie Annabell, The irs taxes capital gains at the federal level and some states also tax capital gains at the state level.

California Capital Gains Tax 2025 Juli Saidee, Kpmg nigeria, a tax and audit advisory firm, criticized the 50% windfall tax on banks’ foreign exchange revaluation gains recorded in 2025, warning it could lead to legal challenges, as nigeria.

Irs Capital Gains Worksheet 2025 Leila Natalya, The tax rate you pay on capital gains depends on:

What’s Your Capital Gains Tax Rate? [2025 + 2025], The withholding tax rate on mutual fund income for resident individuals has been set at 10%.however, if the annual income from mutual funds exceeds rs.